Is a Big Bull Run Coming - Precious Metals, Base Metals, Oil & Commodities?

Today, FOMC Powell surprised the market with a huge dovish FOMC statement, which really was not priced into the market, with the swing in gold, plunge in bond yields all across the board, and expectations / pricing in for a rate cut instead of a rate increase starting to occur.

Some highlights from a few articles I've found, which, in my opinion, could very well lead to a breakout in commodities. Gold, silver, base metals, oil and commodities (your coffee beans, wheat, soy, etc).

Here's, in short, a summary of the FOMC meeting today:

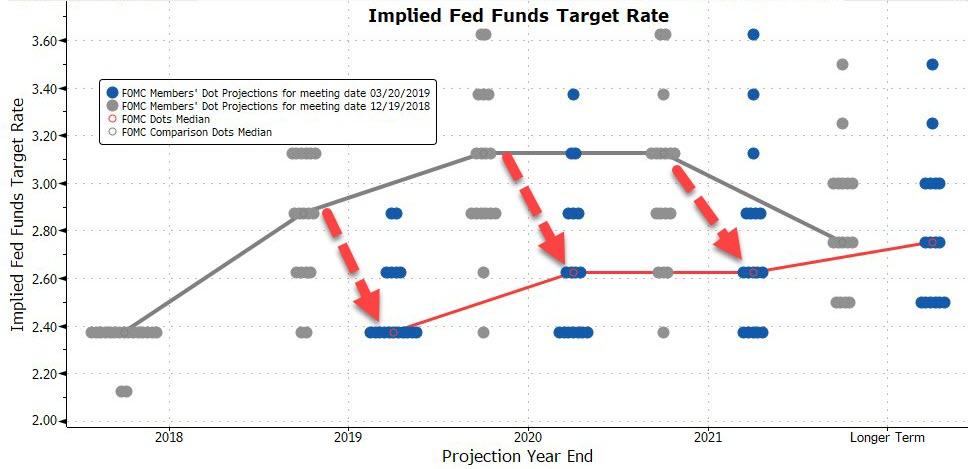

The dot plot is what a lot of folks pay attention to these days, is the projected rates. The dot plot today became a lot more bullish, with lower projected interest rates coming.

A lower target interest rate means that the US dollar will likely weaken.

When the US dollar weakens, folks will look to precious metals (gold/silver), base metals will be priced higher in US dollars (ex: copper), and oil will all go up as well.

All is not rosy perhaps though, as the Fed would only halt hike-rates if they thought there were risks.... and an article on ZeroHedge puts it nicely -

"Fed Returns To The Punchbowl": The Biggest Surprises In Today's Fed Decision"

- Fed leaves rates unchanged, says economic growth has slowed form Q4, even as labor market still strong, job gains solid"

-

The Fed has some 'splaining to do. The market is pricing in 16bps of

rate-cuts in 2019 while they are forecasting - at last call - 2

rate-hikes..."

Gold

This appears to be the end of the road for fed policy tightening, and a shift back to easing again, which shot up gold to $1,900 an oz back in 2011 when QE was in full swing.

That said, I think the coming weeks, months and this year, will be extremely bullish for the junior mining exploration companies especially, and also the gold producers.

In the extremely short term, I've placed a few very near-term bets on call options on GLD (mirrors gold) and XGD (gold miners on the TSX), on my interpretation of this as a huge change that is ongoing, and perhaps we break key technical levels of gold at $1340/1350 and make a run to $1400 in the coming months.

Base Metals

Copper has been trying to break through the $3 mark for several months now.

https://www.bloomberg.com/news/articles/2019-03-18/biggest-trading-in-copper-options-ever-signals-supply-troubles

"The biggest trading volume in copper call options on record signals supply troubles brewing in the market.

A

spread trade worth $6.5 million was posted just after 7 a.m. on Comex

in New York in a bet that the price of the metal used in wires and pipes

will surge past $3.05 in a few months, from Monday’s settlement price

of $2.909."

If the USD starts moving down from here, as I suspect it may, whoever placed that bet on Monday may be on some windfall profits in short order.

Meanwhile, nickel and zinc inventories have been dropping off and continue the trend downwards over the past year. Nickel demand is going straight up over the next several years with EV in demand (electric batteries) and zinc supply seems to have dried up.

All in all, I think the coming months will be very bullish all around. There are many opportunities if you look around in the junior space, and if you are not a big risk-taker, buying the big producers (base metals and gold miners and oil producers) may make sense.

Disclaimer:

The author is not a registered

investment advisorThe

author has not been paid by anyone to write this article. All facts are

to be checked

by the reader. This article is provided for information

purposes only, and is not intended to be investment advice of any kind,

and all readers are encouraged to do their own due diligence, and talk

to their own licensed investment advisors prior to making any investment

decisions.

Most Popular Posts in Last 30 Days

- New Found Gold (NFG.V) and Northern Shield (NRN.V) - Gold in The Maritimes

- Evergold Corp - Compelling Junior Explorecos Mini-Series [TSXV: EVER][OTC:EVGUF]

- Northstar Gold Corp - Compelling Junior Explorecos Mini-Series [CSE:NSG]

- Etruscus Resources (ETR.V) - New Exciting 2023 Targets in the Golden Triangle

- Tombill Mines - Interview with CEO Adam Horne and Geologist Tim Twomey [TSXV:TBLL]

Wednesday, March 20, 2019

Thursday, March 14, 2019

Drill Plays - Assays Pending (GGI.V, IMR.V, SUP.V, MONT.CN, ARU.V, IRV.CN)

Drill Plays, Assays Pending [TM] (GGI.V, IMR.V, SUP.V, MONT.CN, ARU.V, IRV.V)

PS: As a junior mining investor, the best way to poke fun at investors is to tell them assays are imminent! And the second the assays are out, the hoards and mobs will demand the next assays, and if there are none, demand more drilling. Repeat and rinse!

All of the following companies have drilled or are drilling, and have assays to be reported from their previous, or ongoing drill programs.

I'm expecting an exciting next month or two, with results coming from the companies below, and hopefully with good intersections/results, a lot more drilling to follow up on the properties.

The TSX Venture needs some excitement!

GGI.V - (Garibaldi Resources Corp)

It's been quite the long wait (understatement!) for assays. Let's not forget that GGI has 13 holes left to be reported from the 2018 season; 3848meters in total, or more than the amount of meters drilled in the 2017 season.

Last traded at $0.99, 108.6million shares outstanding.

IMR.V - (iMetal Resources Inc)

The company today reported "it has closed a hard dollar private placement at 15 cents per unit for gross proceeds of $250,000" importantly with "A new institutional investor is participating for the largest portion of the placement. Insiders of the Company have

subscribed for an aggregate of 146,667 units".

Notice also that the PP was at $0.15 (but with a full WT at $0.20), but was 30% over the last closing price. This is good to see. You can still buy lower than the PP!

I'm expecting to see assays and/or VTEM results soon, as they also mentions that "The Company will be updating investors on developments at Gowganda West in the near future."

Last traded at $0.135, 100.7million shares outstanding.

SUP (Northern Superior Resources Inc - SUP.V)

Northern Superior, on February 14 "is pleased to announce that it has initiated a 5,000 metre ("m") core drill program on its Ti-Pa-Haa-Kaa-Ning ("TPK") gold-silver-copper mineral property, Northwestern Ontario."

I met with the CEO, Tom Morris at PDAC, and followed up after the PDAC, to confirm that a few holes have been drilled and have been sent to labs to be assayed. Results of course, will depend on timing of the labs.

They will also continue drilling for the next little while as their Feb 14 NR stated drill would be over approximately 6 weeks, for a total of around 5,000meters.

The current market cap is only $8million, the current drilling program is being funded by a major, "Yamana Gold Inc. ("Yamana"), granting Yamana an option to earn a 70% ownership interest in the Company's 100% owned TPK property, northwestern Ontario.". Minimum spend is $2 million per year (total $10million). For full details see their NR on November 26, 2018 .

I've purchased shares here because of the information available, a recommendation by someone to me, and also the fact the market cap is so low, with no attention from the market on it at all - a historical hole of "TPK-10-004, returned an assay value of 25.9 g/t gold over 13.5m", boulders up to 94gt gold, found at Target 3, the fact that drilling is ongoing, and they've now cleaned up the share structure.

They have extremely detailed presentations on their website at

http://www.nsuperior.com/Investor-Centre/investor-presentations.aspx

Direct Link

http://www.nsuperior.com/cmsAssets/docs/pdfs/Corporate_2019_PDAC_March_v2.pdf

Last traded at $0.25, 35.1million shares outstanding.

MONT.CN (Miramont Resources Corp)

Miramont Resources on January 22nd, 2019 announced that it "is pleased to announce that it has commenced drilling on its Cerro Hermoso project in southern Peru. Up to 5,000 meters will be drilled in this first phase to test three priority targets."

The company aims to drill these 3 targets:

1. Central Breccia Zone: Selective sampling by Miramont has confirmed widespread gold mineralization in this zone with values up to 18 grams per tonne of gold.

2. Stockwork Zone: Values as high as 500 g/t Ag, 3.9% Cu and 10 g/t Au have been found here. Coincident magnetic and conductivity anomalies indicate the potential for a buried intrusion near surface.

3. Carbonate Replacement Zone: This zone is known from a review of historic underground mapping. D Coincident resistivity and conductivity anomalies may indicate the presence of sulfide bearing limestone units continuing to the northwest

Visually, you can see them below.

Hve a look at the magnetics, where the company mentions a possible intrusion.

(much more details on the company's corporate presentation - https://www.miramontresources.com/images/feb2019/Miramont_Presentation.pdf

Now, what I like with exploration stocks, is when a company has magnetics/soil samples/channel samples/grab samples all indicating a possible discovery could be made. Big red/pink blobs, gold/copper/silver samples surrounding drill targets, and a very well respected geologist (Dr. Quinton Hennigh, who is also their Chairman of the board).

Miramont resources checks all these boxes for me and looks quite compelling.

Last traded at $0.56, 54.8million shares outstanding.

ARU .V (Aurania Resources Ltd)

Aurania Resources is a company which has locked up a ton of land in Ecuador. They currently have 16 targets, and are focused right now drilling a target called Crunchy Hill.

On March 8th - the company reported that "Aurania reports that the scout drilling program at the Company’s Crunchy Hill epithermal gold-silver target in southeastern Ecuador is progressing well. The first hole is expected to be completed over the weekend and the second hole at Crunchy Hill will be drilled on a different bearing from the same drill platform as Hole 1. Results will be released in due course after several holes have been completed."

When I first looked at this company, I was scratching my head a bit, $100+ million market cap without a single drill hole! Well, further searching/reading on the company's website (http://www.aurania.com/) and YouTube Channel (https://www.youtube.com/channel/UCdCaUv87co3e5qAE8gSiFWg) found a huge vault of information, which was very compelling.

Keith Barron & other folks involved in ARU discovered the largest gold deposit in Ecuador over 10 years ago (14m Oz! at Fruta del Norte) with a company called Aurelien Resources bought out for $1.2b- it was so big that authorities didn't know how to handle it, and laws/regulations had to be put in place. It's finally being put into production this year, see this article here from January this year http://www.mining.com/lundin-kicks-off-underground-work-flagship-fruta-del-norte-project/.

Keith, in his videos, states that he studied the area of the new claims that ARU has obtained, for over 10 years. A lot of research, on the ground work has been done by Keith and team over the past few years to get to this point to start drilling.

Like Miramont, there is a plethora of samples, maps and of course management (which by the way owns more than 55% of the company!) checks all my boxes for a speculative play.

It's in elephant country, looking for elephant deposits.

Do have a look at their site and YouTube channel to learn more.

Last traded at $3.89, 32.8million shares outstanding.

IRV.CN (Irving Resources Inc)

And lastly, Irving Resources. Like Auriana Resources, several years of work have gone into preparing the first drilling program on their property in Hokkaido, Japan.

Drilling was announced to have started on March 13, 2019. "All necessary work permits have been received for its drill crew, and it has commenced diamond drilling at its Omu Gold Project in Hokkaido, Japan. Drilling is being conducted by Mitsui Mineral Development Engineering Co., Ltd. (“MINDECO”) and Rodren Drilling International Ltd., Winnipeg, Manitoba. The first target that will be tested is the Omu Sinter, an 8-20 meter thick terrace of silica that was deposited within an ancient hot-spring pool."

The company plans to start with 8 holes, and expand to 15 if the first 8 drill holes look good.

Let's go over the short checklist again: samples, mapping, management.

1. Samples: "Irving discovered the Omu Sinter in late 2016, and subsequent prospecting resulted in collection of spot rock chip samples grading up to 14.6 gpt Au and 50.8 gpt Ag" - check!

2. Mapping/Surveys: Check! (see corporate presentation)

3. Management/Geologists: Dr. Quinton Hennigh - check!

Learn more about Irving Resources by having a look at their corporate presentation https://www.irvresources.com/assets/docs/ppt/Irving-presentation-Mar1-2019revMar6-reduce.pdf

Japan is no stranger to high grade gold deposits, just look at the Hishikari Mine, currently operating producing over 200k oz of gold a year, with a grade of over 30gpt gold. The Hishikari Mine is a epithermal gold target, which is true of the Omu Gold Project as well.

Last traded at $2.09, 43.9million shares outstanding.

Did not get to cover all the stocks I wanted too today, perhaps I'll make a part 2, at some time, or combine with an update on how these drill plays end up.

Disclaimer:

The author is not a registered investment advisor, currently has long positions in these stocks. The author has not been paid by anyone to write this article. All facts are to be checked by the reader. For more information go to the company's respective website(s) and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

PS: As a junior mining investor, the best way to poke fun at investors is to tell them assays are imminent! And the second the assays are out, the hoards and mobs will demand the next assays, and if there are none, demand more drilling. Repeat and rinse!

All of the following companies have drilled or are drilling, and have assays to be reported from their previous, or ongoing drill programs.

I'm expecting an exciting next month or two, with results coming from the companies below, and hopefully with good intersections/results, a lot more drilling to follow up on the properties.

The TSX Venture needs some excitement!

GGI.V - (Garibaldi Resources Corp)

It's been quite the long wait (understatement!) for assays. Let's not forget that GGI has 13 holes left to be reported from the 2018 season; 3848meters in total, or more than the amount of meters drilled in the 2017 season.

Last traded at $0.99, 108.6million shares outstanding.

IMR.V - (iMetal Resources Inc)

The company today reported "it has closed a hard dollar private placement at 15 cents per unit for gross proceeds of $250,000" importantly with "A new institutional investor is participating for the largest portion of the placement. Insiders of the Company have

subscribed for an aggregate of 146,667 units".

Notice also that the PP was at $0.15 (but with a full WT at $0.20), but was 30% over the last closing price. This is good to see. You can still buy lower than the PP!

I'm expecting to see assays and/or VTEM results soon, as they also mentions that "The Company will be updating investors on developments at Gowganda West in the near future."

Last traded at $0.135, 100.7million shares outstanding.

SUP (Northern Superior Resources Inc - SUP.V)

Northern Superior, on February 14 "is pleased to announce that it has initiated a 5,000 metre ("m") core drill program on its Ti-Pa-Haa-Kaa-Ning ("TPK") gold-silver-copper mineral property, Northwestern Ontario."

I met with the CEO, Tom Morris at PDAC, and followed up after the PDAC, to confirm that a few holes have been drilled and have been sent to labs to be assayed. Results of course, will depend on timing of the labs.

They will also continue drilling for the next little while as their Feb 14 NR stated drill would be over approximately 6 weeks, for a total of around 5,000meters.

The current market cap is only $8million, the current drilling program is being funded by a major, "Yamana Gold Inc. ("Yamana"), granting Yamana an option to earn a 70% ownership interest in the Company's 100% owned TPK property, northwestern Ontario.". Minimum spend is $2 million per year (total $10million). For full details see their NR on November 26, 2018 .

I've purchased shares here because of the information available, a recommendation by someone to me, and also the fact the market cap is so low, with no attention from the market on it at all - a historical hole of "TPK-10-004, returned an assay value of 25.9 g/t gold over 13.5m", boulders up to 94gt gold, found at Target 3, the fact that drilling is ongoing, and they've now cleaned up the share structure.

They have extremely detailed presentations on their website at

http://www.nsuperior.com/Investor-Centre/investor-presentations.aspx

Direct Link

http://www.nsuperior.com/cmsAssets/docs/pdfs/Corporate_2019_PDAC_March_v2.pdf

Last traded at $0.25, 35.1million shares outstanding.

MONT.CN (Miramont Resources Corp)

Miramont Resources on January 22nd, 2019 announced that it "is pleased to announce that it has commenced drilling on its Cerro Hermoso project in southern Peru. Up to 5,000 meters will be drilled in this first phase to test three priority targets."

The company aims to drill these 3 targets:

1. Central Breccia Zone: Selective sampling by Miramont has confirmed widespread gold mineralization in this zone with values up to 18 grams per tonne of gold.

2. Stockwork Zone: Values as high as 500 g/t Ag, 3.9% Cu and 10 g/t Au have been found here. Coincident magnetic and conductivity anomalies indicate the potential for a buried intrusion near surface.

3. Carbonate Replacement Zone: This zone is known from a review of historic underground mapping. D Coincident resistivity and conductivity anomalies may indicate the presence of sulfide bearing limestone units continuing to the northwest

Visually, you can see them below.

Hve a look at the magnetics, where the company mentions a possible intrusion.

(much more details on the company's corporate presentation - https://www.miramontresources.com/images/feb2019/Miramont_Presentation.pdf

Now, what I like with exploration stocks, is when a company has magnetics/soil samples/channel samples/grab samples all indicating a possible discovery could be made. Big red/pink blobs, gold/copper/silver samples surrounding drill targets, and a very well respected geologist (Dr. Quinton Hennigh, who is also their Chairman of the board).

Miramont resources checks all these boxes for me and looks quite compelling.

Last traded at $0.56, 54.8million shares outstanding.

ARU .V (Aurania Resources Ltd)

Aurania Resources is a company which has locked up a ton of land in Ecuador. They currently have 16 targets, and are focused right now drilling a target called Crunchy Hill.

On March 8th - the company reported that "Aurania reports that the scout drilling program at the Company’s Crunchy Hill epithermal gold-silver target in southeastern Ecuador is progressing well. The first hole is expected to be completed over the weekend and the second hole at Crunchy Hill will be drilled on a different bearing from the same drill platform as Hole 1. Results will be released in due course after several holes have been completed."

When I first looked at this company, I was scratching my head a bit, $100+ million market cap without a single drill hole! Well, further searching/reading on the company's website (http://www.aurania.com/) and YouTube Channel (https://www.youtube.com/channel/UCdCaUv87co3e5qAE8gSiFWg) found a huge vault of information, which was very compelling.

Keith Barron & other folks involved in ARU discovered the largest gold deposit in Ecuador over 10 years ago (14m Oz! at Fruta del Norte) with a company called Aurelien Resources bought out for $1.2b- it was so big that authorities didn't know how to handle it, and laws/regulations had to be put in place. It's finally being put into production this year, see this article here from January this year http://www.mining.com/lundin-kicks-off-underground-work-flagship-fruta-del-norte-project/.

Keith, in his videos, states that he studied the area of the new claims that ARU has obtained, for over 10 years. A lot of research, on the ground work has been done by Keith and team over the past few years to get to this point to start drilling.

Like Miramont, there is a plethora of samples, maps and of course management (which by the way owns more than 55% of the company!) checks all my boxes for a speculative play.

It's in elephant country, looking for elephant deposits.

Do have a look at their site and YouTube channel to learn more.

Last traded at $3.89, 32.8million shares outstanding.

IRV.CN (Irving Resources Inc)

And lastly, Irving Resources. Like Auriana Resources, several years of work have gone into preparing the first drilling program on their property in Hokkaido, Japan.

Drilling was announced to have started on March 13, 2019. "All necessary work permits have been received for its drill crew, and it has commenced diamond drilling at its Omu Gold Project in Hokkaido, Japan. Drilling is being conducted by Mitsui Mineral Development Engineering Co., Ltd. (“MINDECO”) and Rodren Drilling International Ltd., Winnipeg, Manitoba. The first target that will be tested is the Omu Sinter, an 8-20 meter thick terrace of silica that was deposited within an ancient hot-spring pool."

The company plans to start with 8 holes, and expand to 15 if the first 8 drill holes look good.

Let's go over the short checklist again: samples, mapping, management.

1. Samples: "Irving discovered the Omu Sinter in late 2016, and subsequent prospecting resulted in collection of spot rock chip samples grading up to 14.6 gpt Au and 50.8 gpt Ag" - check!

2. Mapping/Surveys: Check! (see corporate presentation)

3. Management/Geologists: Dr. Quinton Hennigh - check!

Learn more about Irving Resources by having a look at their corporate presentation https://www.irvresources.com/assets/docs/ppt/Irving-presentation-Mar1-2019revMar6-reduce.pdf

Japan is no stranger to high grade gold deposits, just look at the Hishikari Mine, currently operating producing over 200k oz of gold a year, with a grade of over 30gpt gold. The Hishikari Mine is a epithermal gold target, which is true of the Omu Gold Project as well.

Last traded at $2.09, 43.9million shares outstanding.

Did not get to cover all the stocks I wanted too today, perhaps I'll make a part 2, at some time, or combine with an update on how these drill plays end up.

Disclaimer:

The author is not a registered investment advisor, currently has long positions in these stocks. The author has not been paid by anyone to write this article. All facts are to be checked by the reader. For more information go to the company's respective website(s) and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Friday, March 8, 2019

Garibaldi Resources at PDAC 2019

Garibaldi Resources at PDAC 2019

At the world's largest mining convention, Garibaldi Resources was there to show off their core, massive sulphide block, answer question from investors, and meet some larger companies/institutions.

I had chance to visit the booth at PDAC, speak with management and the geologists; spoke with them at length and I think that the company is on the right track to build this discovery out with continued drilling in 2019, which is fully funded with $15 million cash in the bank, and several million more potentially available with warrants coming in by October.

Remember, Garibaldi was hit severe lab delays, and my understanding is that the company still does not have all the results back from drilling completed from the 2018 season, but would expect them to report them once they are available. There are still 13 holes remaining, and several thousand meters. We know that several of these holes are coming from under the ice/crevasse zone (massive sulphide outcrop newly exposed last season).

So, all in all, there's lot of updates to come from Nickel Mountain, and if you read my blog post on Q3 financials, you'd know that the company spent money elsewhere, so I'd expect at some point the company will come out with some results from there as well.

Before we get into more... let's look at the most recent news release

The [February 21 NR] contains several key items, and instead of hearing it from me, I've taken, with permission, a post by Larry Hoover on a chatboard site and broken it down:

1. "The most important information is in the section/plan mapping. You may recall that I earlier criticized an angrygeo model for under-estimating the tonnage, primarily because the lower grades were significantly under-represented. In earlier and more conservative modeling by the company, the Upper and Lower Discovery Zones were separated by unmineralized rock, but now they are shown as fully continuous mineralization. "

"That dramatically boosts the tonnage, while simultaneously improving the mining economics, if this deposit becomes a mine in the future. All of the rock in that continuous mineralized zone would be treated as ore, simplifying the mining process because you would not have to manage internal zones of waste. Your focus is therefore directed at managing the external boundaries for the large mineralized zone."

2. "We learned about a number of purely exploratory holes surrounding the known mineralization. Had any of them hit reportable mineralization (greater than low-cut grade), that would have been pure serendipity. But not having reportable grades is not purely a negative outcome. You can't rule out mineralization in a large volume of previously unexplored rock with a single hole. Nickel exploration is a perfect application for borehole geophysics which can turn what appears to be a miss into a bullseye drillhole in the future. They continued drilling long after these holes were done, so I will know better what they learned from these specific holes, based on what they did later. "

3. "Hole 13 looked like a miss from the 2017 program, but it helped them drill off a lot more massive sulphides in the Discovery Zone to open the 2018 season. And now we learn, “Drill hole EL-18-29 was a 700-meter step-out to the southeast, targeting the center of the Anomaly F VTEM conductor. The hole intersected a thick sequence of volcanics with some sedimentary rocks. The sparse pyritic mineralization encountered would not explain the conductivity.” The great thing about exploring for massive sulphides is that they respond in borehole electromagnetic surveys. Something conductive was observed in aerial geophysics, and that something can be pinned down with in-ground geophysics, even though it wasn’t encountered in the recovered core. Hole 26 was collared adjacent to the adit, and encountered taxitic gabbro and disseminated sulphides (both associated with massive sulphides higher up the mountain). Holes 28 and 32 stepped out even further down the mountain (the so-called donkey pad (thanks Brent for taking the picture of it)). Hole 28 encountered melagabbro with trace sulphides at a depth very crudely 1.3 km from the pads at the summit. So, the intrusion has deep roots, and I’m sure BHEM will provide off-hole data for these holes as well. Lots of work for these lads to isolate drill targets for next year. "

4. "I’m looking forward to seeing the rest of the drill data, which will include Hole 41, a hole that we already know encountered massive sulphides in the vicinity of the bedrock exposure (Crevasse Showing) adjacent to the glacier to the north. I’m also looking forward to seeing a 3D model of the mineralization, which should follow on from and include the remaining drill results. The idea that there are multiple stacked flat-lying sheets of massive sulphides strongly suggests that there may be similar beds beneath the ice. This is also consistent with the discovery of taxitic and variable-textured gabbro to the north and east of the glacier. Engineer showed me some Minfile data from a field program conducted in 2016. XRF results for samples encountered adjacent to the glacier include a number of results at about 13% copper. He plotted those on a map:

Not too shabby. Lots to look forward to, especially with all this new data to guide the drilling."

PDAC Photos & Commentary

Now, onto some cool photos from the Garibaldi core shack booth this year.

The original 390/400lb massive sulphide block was cut down, this is one of the pieces that formed out of that.

Expanded assay tables for EL-18-33 and EL-17-04

EL-18-33 corebox

EL-17-04 corebox

EL-18-04 corebox 2

390/400lb massive sulphide block cut down into a cube (now weighing 200lbs)

The top of the massive sulphide block.

Crevasse Zone!

We now have assays for this massive sulphide block, similar to discovery, over 7% nickel and 2% copper with PGEs and Gold as well.

EL-18-20 corebox

EL-18-20 corebox 2

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock. The author has not been paid by anyone to write this article. All facts are to be checked by the reader. For more information go to www.garibaldiresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

At the world's largest mining convention, Garibaldi Resources was there to show off their core, massive sulphide block, answer question from investors, and meet some larger companies/institutions.

I had chance to visit the booth at PDAC, speak with management and the geologists; spoke with them at length and I think that the company is on the right track to build this discovery out with continued drilling in 2019, which is fully funded with $15 million cash in the bank, and several million more potentially available with warrants coming in by October.

Remember, Garibaldi was hit severe lab delays, and my understanding is that the company still does not have all the results back from drilling completed from the 2018 season, but would expect them to report them once they are available. There are still 13 holes remaining, and several thousand meters. We know that several of these holes are coming from under the ice/crevasse zone (massive sulphide outcrop newly exposed last season).

So, all in all, there's lot of updates to come from Nickel Mountain, and if you read my blog post on Q3 financials, you'd know that the company spent money elsewhere, so I'd expect at some point the company will come out with some results from there as well.

Before we get into more... let's look at the most recent news release

The [February 21 NR] contains several key items, and instead of hearing it from me, I've taken, with permission, a post by Larry Hoover on a chatboard site and broken it down:

1. "The most important information is in the section/plan mapping. You may recall that I earlier criticized an angrygeo model for under-estimating the tonnage, primarily because the lower grades were significantly under-represented. In earlier and more conservative modeling by the company, the Upper and Lower Discovery Zones were separated by unmineralized rock, but now they are shown as fully continuous mineralization. "

"That dramatically boosts the tonnage, while simultaneously improving the mining economics, if this deposit becomes a mine in the future. All of the rock in that continuous mineralized zone would be treated as ore, simplifying the mining process because you would not have to manage internal zones of waste. Your focus is therefore directed at managing the external boundaries for the large mineralized zone."

2. "We learned about a number of purely exploratory holes surrounding the known mineralization. Had any of them hit reportable mineralization (greater than low-cut grade), that would have been pure serendipity. But not having reportable grades is not purely a negative outcome. You can't rule out mineralization in a large volume of previously unexplored rock with a single hole. Nickel exploration is a perfect application for borehole geophysics which can turn what appears to be a miss into a bullseye drillhole in the future. They continued drilling long after these holes were done, so I will know better what they learned from these specific holes, based on what they did later. "

3. "Hole 13 looked like a miss from the 2017 program, but it helped them drill off a lot more massive sulphides in the Discovery Zone to open the 2018 season. And now we learn, “Drill hole EL-18-29 was a 700-meter step-out to the southeast, targeting the center of the Anomaly F VTEM conductor. The hole intersected a thick sequence of volcanics with some sedimentary rocks. The sparse pyritic mineralization encountered would not explain the conductivity.” The great thing about exploring for massive sulphides is that they respond in borehole electromagnetic surveys. Something conductive was observed in aerial geophysics, and that something can be pinned down with in-ground geophysics, even though it wasn’t encountered in the recovered core. Hole 26 was collared adjacent to the adit, and encountered taxitic gabbro and disseminated sulphides (both associated with massive sulphides higher up the mountain). Holes 28 and 32 stepped out even further down the mountain (the so-called donkey pad (thanks Brent for taking the picture of it)). Hole 28 encountered melagabbro with trace sulphides at a depth very crudely 1.3 km from the pads at the summit. So, the intrusion has deep roots, and I’m sure BHEM will provide off-hole data for these holes as well. Lots of work for these lads to isolate drill targets for next year. "

4. "I’m looking forward to seeing the rest of the drill data, which will include Hole 41, a hole that we already know encountered massive sulphides in the vicinity of the bedrock exposure (Crevasse Showing) adjacent to the glacier to the north. I’m also looking forward to seeing a 3D model of the mineralization, which should follow on from and include the remaining drill results. The idea that there are multiple stacked flat-lying sheets of massive sulphides strongly suggests that there may be similar beds beneath the ice. This is also consistent with the discovery of taxitic and variable-textured gabbro to the north and east of the glacier. Engineer showed me some Minfile data from a field program conducted in 2016. XRF results for samples encountered adjacent to the glacier include a number of results at about 13% copper. He plotted those on a map:

Not too shabby. Lots to look forward to, especially with all this new data to guide the drilling."

PDAC Photos & Commentary

Now, onto some cool photos from the Garibaldi core shack booth this year.

The original 390/400lb massive sulphide block was cut down, this is one of the pieces that formed out of that.

Expanded assay tables for EL-18-33 and EL-17-04

EL-18-33 corebox

EL-17-04 corebox

EL-18-04 corebox 2

390/400lb massive sulphide block cut down into a cube (now weighing 200lbs)

The top of the massive sulphide block.

Crevasse Zone!

We now have assays for this massive sulphide block, similar to discovery, over 7% nickel and 2% copper with PGEs and Gold as well.

EL-18-20 corebox

EL-18-20 corebox 2

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock. The author has not been paid by anyone to write this article. All facts are to be checked by the reader. For more information go to www.garibaldiresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Thursday, March 7, 2019

Rick Rule (Sprott Inc.) at PDAC 2019

PDAC 2019 - Rick Rule (Sprott Inc.) Talk

I had the opportunity to go to PDAC 2019 and sat in on a session done by Rick Rule. Recorded the audio and posted on YouTube. Hope you enjoy it!

Some of the topics covered include:

- Major trends that Rick sees for the coming year 2019

- What I'm doing with my own money and why

- Gold , gold securities

- Supply desctruction

- Unfunded liabilities/debt

- Canada

- Uranium

I had the opportunity to go to PDAC 2019 and sat in on a session done by Rick Rule. Recorded the audio and posted on YouTube. Hope you enjoy it!

Some of the topics covered include:

- Major trends that Rick sees for the coming year 2019

- What I'm doing with my own money and why

- Gold , gold securities

- Supply desctruction

- Unfunded liabilities/debt

- Canada

- Uranium

Subscribe to:

Posts (Atom)