Is a Big Bull Run Coming - Precious Metals, Base Metals, Oil & Commodities?

Today, FOMC Powell surprised the market with a huge dovish FOMC statement, which really was not priced into the market, with the swing in gold, plunge in bond yields all across the board, and expectations / pricing in for a rate cut instead of a rate increase starting to occur.

Some highlights from a few articles I've found, which, in my opinion, could very well lead to a breakout in commodities. Gold, silver, base metals, oil and commodities (your coffee beans, wheat, soy, etc).

Here's, in short, a summary of the FOMC meeting today:

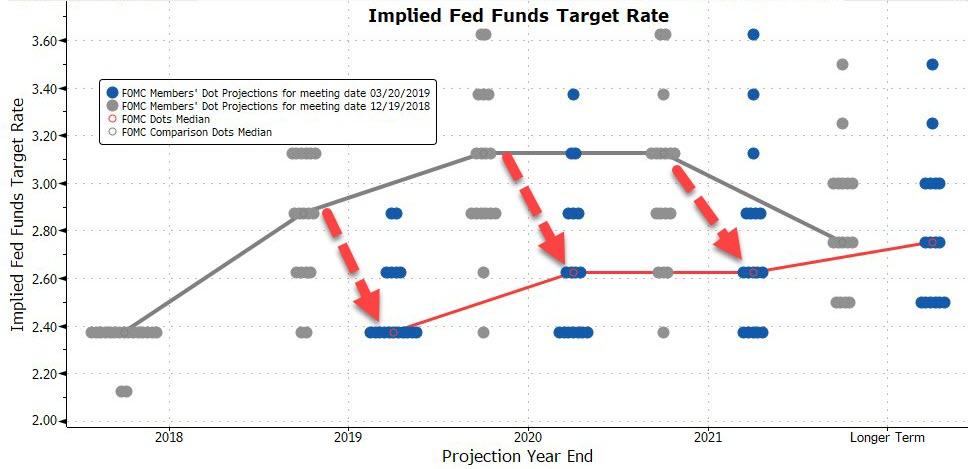

The dot plot is what a lot of folks pay attention to these days, is the projected rates. The dot plot today became a lot more bullish, with lower projected interest rates coming.

A lower target interest rate means that the US dollar will likely weaken.

When the US dollar weakens, folks will look to precious metals (gold/silver), base metals will be priced higher in US dollars (ex: copper), and oil will all go up as well.

All is not rosy perhaps though, as the Fed would only halt hike-rates if they thought there were risks.... and an article on ZeroHedge puts it nicely -

"Fed Returns To The Punchbowl": The Biggest Surprises In Today's Fed Decision"

- Fed leaves rates unchanged, says economic growth has slowed form Q4, even as labor market still strong, job gains solid"

-

The Fed has some 'splaining to do. The market is pricing in 16bps of

rate-cuts in 2019 while they are forecasting - at last call - 2

rate-hikes..."

Gold

This appears to be the end of the road for fed policy tightening, and a shift back to easing again, which shot up gold to $1,900 an oz back in 2011 when QE was in full swing.

That said, I think the coming weeks, months and this year, will be extremely bullish for the junior mining exploration companies especially, and also the gold producers.

In the extremely short term, I've placed a few very near-term bets on call options on GLD (mirrors gold) and XGD (gold miners on the TSX), on my interpretation of this as a huge change that is ongoing, and perhaps we break key technical levels of gold at $1340/1350 and make a run to $1400 in the coming months.

Base Metals

Copper has been trying to break through the $3 mark for several months now.

https://www.bloomberg.com/news/articles/2019-03-18/biggest-trading-in-copper-options-ever-signals-supply-troubles

"The biggest trading volume in copper call options on record signals supply troubles brewing in the market.

A

spread trade worth $6.5 million was posted just after 7 a.m. on Comex

in New York in a bet that the price of the metal used in wires and pipes

will surge past $3.05 in a few months, from Monday’s settlement price

of $2.909."

If the USD starts moving down from here, as I suspect it may, whoever placed that bet on Monday may be on some windfall profits in short order.

Meanwhile, nickel and zinc inventories have been dropping off and continue the trend downwards over the past year. Nickel demand is going straight up over the next several years with EV in demand (electric batteries) and zinc supply seems to have dried up.

All in all, I think the coming months will be very bullish all around. There are many opportunities if you look around in the junior space, and if you are not a big risk-taker, buying the big producers (base metals and gold miners and oil producers) may make sense.

Disclaimer:

The author is not a registered

investment advisorThe

author has not been paid by anyone to write this article. All facts are

to be checked

by the reader. This article is provided for information

purposes only, and is not intended to be investment advice of any kind,

and all readers are encouraged to do their own due diligence, and talk

to their own licensed investment advisors prior to making any investment

decisions.